Why Trade in Commodities on MCX?

- vivekkhemka

- Apr 30, 2024

- 3 min read

Updated: May 20, 2024

If you're familiar with trading securities or index derivatives on NSE but haven't yet explored the dynamic world of commodities trading, you might wonder why you should consider this exciting avenue. Trading commodity futures on the Multi Commodity Exchange (MCX), India's leading exchange for commodities, offers several compelling advantages over trading Nifty, Banknifty, or stock futures. Here’s why diving into commodities could be a game-changer for your trading strategy:

Diversified Risk with Mini Lots - One of the standout features of MCX is the availability of mini lots in several commodities. This means you can spread your risk more effectively with a relatively small capital. For instance, with an investment of INR 2 lakhs, you can engage in futures trading across up to 4 mini lots of different commodities such as zinc, silver, crude oil, and natural gas. In comparison, the same capital would only allow you to trade in only 2 lots of Nifty futures. This diversification can significantly enhance your risk management and potential returns.

For example, let’s say you allocate INR 1,00,000 each to Metals (Zinc, Aluminium, Silver) and Energy (Crude and Natural Gas). Hence your risk is spread across two different asset classes with uncorrelated price action. An adverse price movement across one asset class may be compensated by a favourable move across the other, thereby reducing overall risk. This is particularly useful in volatile markets where single-commodity exposure can be risky.

Global Price Mimicry - Commodity prices on MCX closely follow international price trends, making them less susceptible to manipulation. Unlike Nifty or Banknifty, which can be influenced by a few heavyweight stocks, commodity prices reflect global supply and demand dynamics. This international linkage provides a more stable and predictable trading environment.

For example, the price of crude oil on MCX closely follows WTI Crude traded on Nymex (NY Mercantile Exchange). This alignment with international markets ensures that the price movements are more logical and less prone to localized manipulations, providing a fairer trading playground.

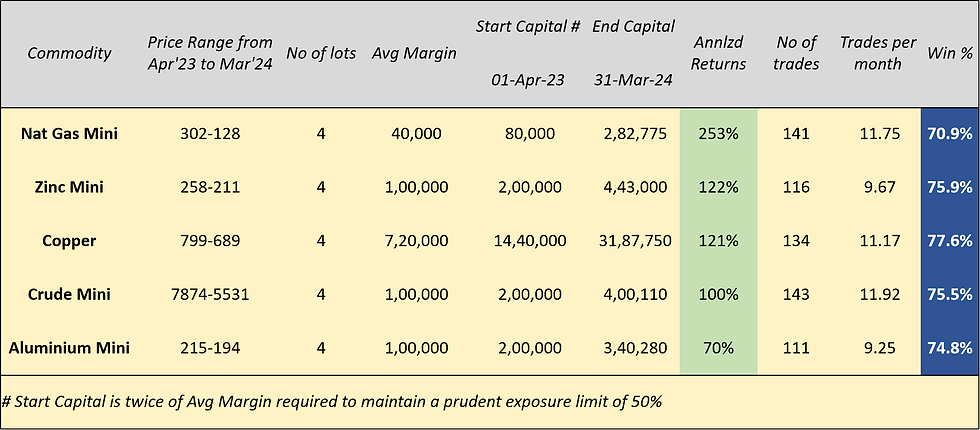

Proven setups with more predictable outcomes - Our trading system on MCX focuses on a select number of proven setups using 2-hour candlestick charts. These strategies are specifically tailored for commodities, offering a high win ratio and predictability. The setups are simple to learn and practice, allowing traders to quickly master them and achieve consistent results.

For instance, one popular setup is based on the "Bullish Hammer" candlestick pattern. When this setup appears, it often signals a strong upward movement, allowing traders to capitalize on the trend with confidence. Detailed explanations of these bullish and bearish setups are available in our dedicated sections, helping you to understand and implement them effectively.

Longer trading window - MCX offers a longer trading window from 9 AM to 11:30 PM, which includes the critical period when US markets open. This extended window provides unique opportunities to design strategies around the US market's opening, an advantage not available with Nifty, Banknifty, or other securities on NSE. This flexibility can significantly enhance your trading opportunities and potential for profit.

For example, if you notice a promising setup appearing by 5 PM or 7PM, you can execute your trades on MCX as the US markets open. Many of the major economic news that impacts world markets gets released in the window of 5 to 7 PM. This extended trading period thus allows you to react to global news and events in real-time, ensuring you never miss out on potential trading opportunities.

Please click on "Next Post" to move to Which Commodities to Trade on MCX.

コメント