What does it take to Discover the Winning Edge ?

- vivekkhemka

- Apr 30, 2024

- 2 min read

Updated: May 20, 2024

What does it take to discover the winning edge in trading commodities? What does it take to make a career in trading commodities professionally and making money consistently?

Essentially, engaging in commodity trading (or any form of trading) resembles preparing a delectable dish. It's not merely about following a recipe; the quality of ingredients and your temperament play crucial roles, often honed through experience and practice.

To elaborate on this analogy within the trading realm: the recipe equates to trading setups or patterns, while the other ingredients encompass strategies for handling money, risk, and profits. Your temperament represents your capacity to make reasoned choices amidst market turbulence, driven by discipline and control over your own mind.

To put it objectively, what it takes to build a complete and successful Trading System are the following factors, based on our years of experience and research :

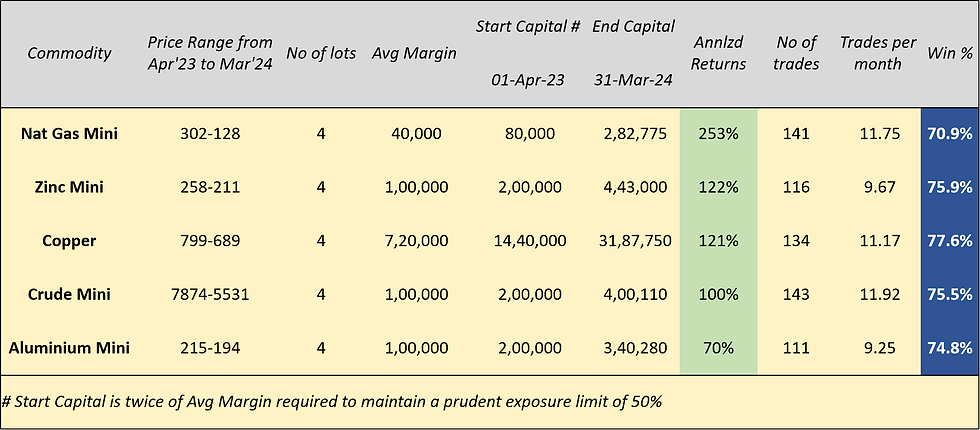

Proven Setups - Proven setups are rigorously researched and backtested to calculate the Win Ratio for each commodity. Only those setups with a high Win Ratio (over 70%) are traded. This high level of confidence ensures that you are trading setups that are statistically proven to succeed.

Proven Strategies -

Money Management - Determine how much exposure you should have relative to your trading capital. Effective money management prevents over-leveraging and ensures sustainable trading.

Risk Management - Define how much to risk on a single trade or a series of trades. By setting strict risk parameters, such as risking only 1-2% of your trading capital per trade, you protect your account from significant losses.

Profit Management - Decide how to pay yourself as the trade progresses. Setting profit targets and trailing stops helps lock in gains as the market moves in your favour.

Trade Selection - Implement a filtering mechanism to select trades with the highest chances of success. This involves using criteria such as long term trend, chart patterns and Win Ratio to choose trades that align with your proven setups.

Psychology Index - Use a tool to monitor your daily adherence to the critical trading rules. Your psychological balance and mindset are crucial in following your trading plan. This tool helps you become aware of your human flaws, building character and discipline over time.

Crafting a Meticulously Built Trading System

Our Trading System, defined by these four key ingredients, has been meticulously built over years of market experience. We've filtered out the clutter, making it simple, easy to learn, and implement. The System is designed to reduce stress and free up your time. If you're willing to learn and practice the System, you’ll find it both rewarding and enjoyable, just like many others.

Now that you know about our Trading System, the next question on your mind would probably be - Can I do it? What is required of me?

Please click on "Next Post" to learn about the Prerequisites to start your learning process in this journey.

Since the setups that we are going to use are unique, how do we keep a track of the WIN ratios for each commodity and setup ? Moreover their ratios would keep changing every quarter, will this data be available on this website or will we have to keep a tab by ourselves ?