Candlestick Pattern - Piercing Pattern or Dark Cloud Cover

- vivekkhemka

- May 10, 2024

- 1 min read

Updated: Jun 23, 2024

The Piercing Pattern is a two candlestick pattern that occur after a significant downtrend, and signals a potential reversal to an uptrend.

The first candlestick is a bearish candlestick, indicating continued selling pressure.

The second candlestick is a bullish candlestick that opens with a gap down below the previous day's low but closes more than halfway into the body of the previous day's bearish candlestick.

(Fig 1.4 - Piercing Pattern and Dark Cloud Cover)

Piercing Pattern suggests that the buyers have found value at the price level that opens with a gap down after a sustained downtrend, indicating a potential reversal from a downtrend to an uptrend.

The pattern becomes more significant when it forms near support levels or after a prolonged downtrend.

Vice versa for Dark Cloud Cover pattern as mentioned above.

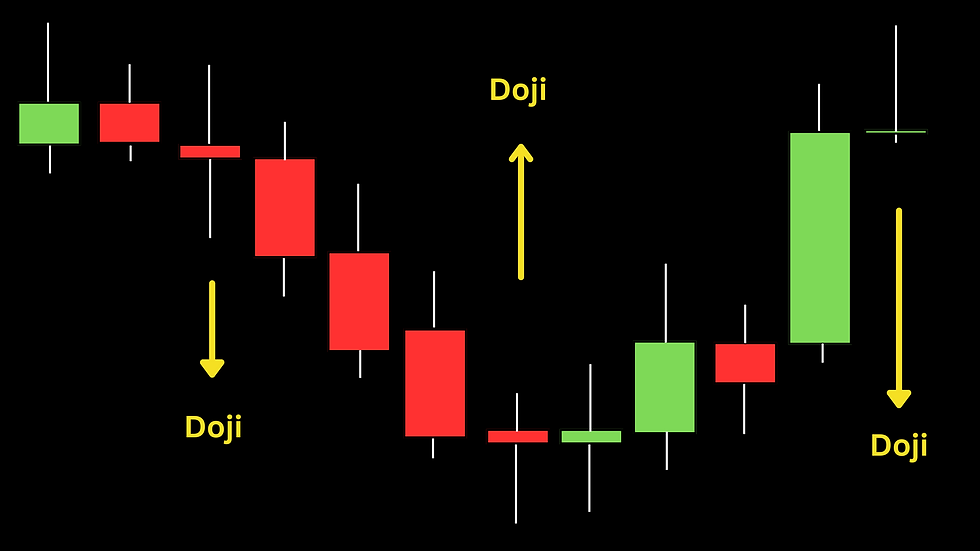

Please click on "Next Post" to move to the next candlestick pattern - Doji

コメント