Bullish Setup 5 : Snake Buy

- vivekkhemka

- Apr 19, 2024

- 3 min read

Updated: May 8, 2024

This post would talk about another PROPRIETARY setup we call as Snake Buy, the fifth Bullish Setup. This is a 4 candlestick continuation pattern that can be likened to a flag formation that denotes consolidation before a big move in same direction. Why the name? It looked to us like a snake on the charts slithering away ready to make the next move!

To be tradable as per our strategy, the following conditions need to be met, part of trade selection.

Being a 4 candle setup, the setup completes on C4 @ 5PM or C5 @ 7PM. Trading conditions are mentioned below separately for trades on C4 @ 5pm and trades on C5 @ 7pm. Note : If you recall from the introductory post on chart setups, trade execution @ 5PM or 7PM depends on the US open. The former applies when the US markets open @ 7PM and the latter when the US markets open @ 8PM during winters.

Trades @ 5PM i.e. completion of C4 - If the setup forms at C4, the trade should be executed if the execution window is @ 5PM.

Trades @ 7PM i.e. completion of C5 - The setup could form at C4 or C5. If the setup forms at C4, C5 should not be an adverse red candle or a long green candle. A narrow range candle (red or green) or a small doji that indicates consolidation is what we are looking for. Some amount of judgment is required. IF THERE IS ANY DOUBT, DO NOT ENTER.

If completing on C4, C1 and C2 should be medium to long green candles closing at or near their respective highs. C3 and C4 should be narrow range candles closing near the high or upper wick area of C2.

Neither of C3 or C4 should expand to close beyond the high of C2. Also, neither of C3 or C4 should be an adverse candle (e.g. a long inverted hammer or a long red candle). We are looking for narrow range candles suggesting consolidation.

The same logic applies for completion of the setup at C5. Replace C1, C2, C3, C4 above with C2, C3, C4 and C5 respectively.

The setup holds more promise if it forms at or just prior to a Pivot Resistance or other Horizontal Resistance. It suggests that price is just biding time before it overcomes resistance. However, the resistance should not be very strong or in a confluence. Pivot or minor horizontal resistance works best. Some judgment is required.

There should be sufficient room to expand before encountering the next level of resistance. A pattern forming very close to strong overhead resistance may not work hence avoid.

Always keep the bigger trend in mind. You should be ready with the weekly and daily view of the chart beforehand. If both are negative, avoid long trades. Take the trade if at least one of these is positive or sideways with a bullish undertone.

By the time the candle completes @ 5 PM or 7 PM, you should have already made up your mind whether to take the trade or step aside, very very important. If you cannot make up your mind, it is best to step aside.

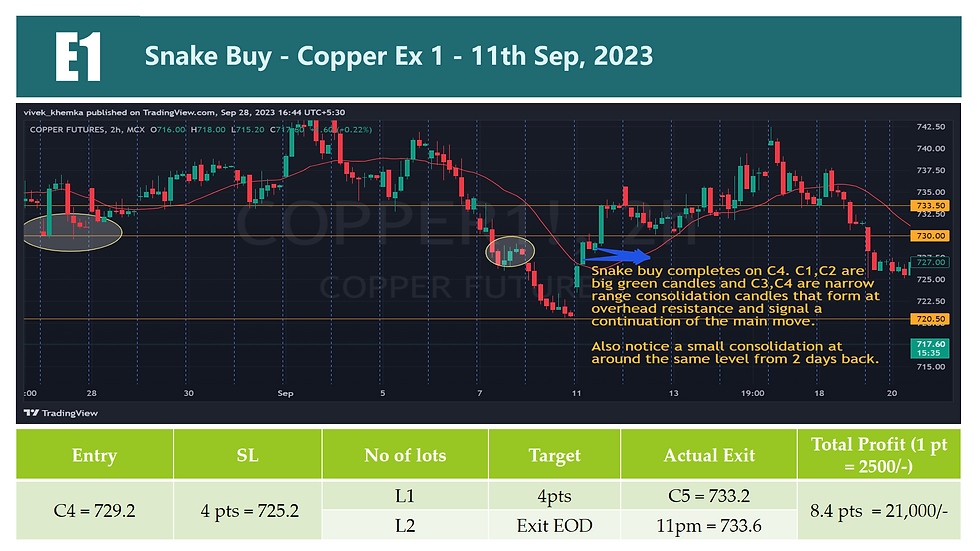

Chart Examples : Please study the following chart examples carefully, across commodities, paying attention to the annotations which explain the price action behind the setup. Observe carefully what happens after the trade is executed.

Trade dynamics in terms of number of lots, Stop Loss, Price Targets by lot and the profit/ loss of the trade is also provided in a table below the chart. Please revisit once we have covered these in the section on Strategy as it would make better sense then.

Win Ratio: The table below provides the Win Ratio for this setup for different commodities, a key component for trade selection.

As is clear from the numbers above, the setup is tradable on Copper and Aluminium. Discretinary for Zinc. Avoid for Crude and N Gas

Now that you know the setup, please look for similar setups on the 2H charts for our chosen basket of commodities. Please share your observation in the Comments along with an image of the chart that you are referring to. We will revert with our comments. Please click on "Next Post" to move to the sixth Bullish Setup - Triple Falling Bottom.

Comments